- CTM POS

- White Label ATMs

- Reference Sample Sites

- E-Payments Gateway

- What is CTM?

- Benefits of CTM

- Book a Demo

- Terms & Conditions

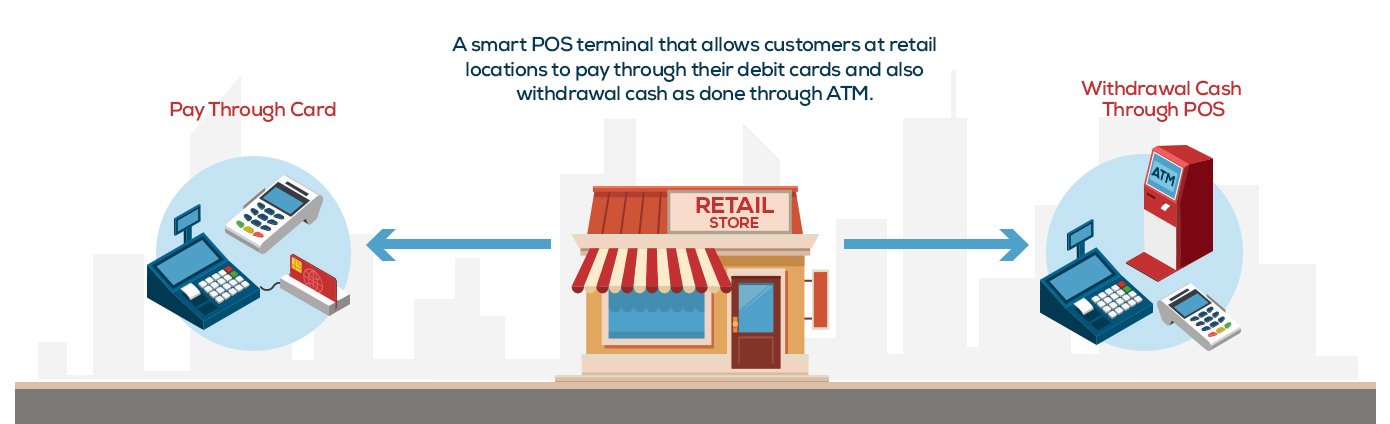

What is CTM?

Cash1 is a Cash Withdrawal and other Cash-based transactions Service offered by Webdnaworks Private Limited (WPL).

Deploying the offered services of Cash1 is critical to improve financial inclusion in Pakistan, a heavily cash-based economy. Majority of business sectors deals in cash only as Cash is the preferred, widely acceptable and trusted mode of transactions in Pakistan.

Only 17% of deployed ATMs are operating independent of Bank Branches. The conventional banking has a thin coverage in tier B cities and even thinner in tier C cities. Therefore, community business and residential areas are still out of such coverage or neglected.

State Bank of Pakistan has granted WPL a mandate of establishing While Label ATM network and expanding the Cash services under a PSP/PSO license and WPL is commercially LIVE. WPL’s business model is crafted to extend nearest and easiest access to cash and other prevalent services in ATM machines for general public.

WPL’s core business vision is based on “Raqam Har Qadam | رقم ہر قدم”, promising to keep its focus on “Cash Services”. WPL is determined to serve the numerous cash solutions to general public and community businesses leveraging its mandate.

Why Deploy CTM at Retail Locations?

- Availability of ATMs is limited, especially in the community areas of tier B and C cities.

- Cash availability in ATMs is highly compromised on weekends and long holidays.

- ATM network is established in clusters on main avenues, whereas most shopping stores are located in community business areas. This means cash may not be easily accessible to customers.

- Provide easy access to cash in community business areas, where retail locations for daily shopping are usually located.

- CTM makes transactions safe and secure for customers by eliminating the need for cash in hand.

- CTM benefits both, customers and retailers – it offers easy access to cash in community areas and reduces cash in business for retailers facing cash management and disposal problems.

- CTM enables human-to-human transactions, attracting more customers to your retail location.

Why Deploy CTM at Retail Locations?

- Availability of ATMs is limited, especially in the community areas of tier B and C cities.

- Cash availability in ATMs is highly compromised on weekends and long holidays.

- ATM network is established in clusters on main avenues, whereas most shopping stores are located in community business areas. This means cash may not be easily accessible to customers.

- Provide easy access to cash in community business areas, where retail locations for daily shopping are usually located.

- CTM makes transactions safe and secure for customers by eliminating the need for cash in hand.

- CTM benefits both, customers and retailers – it offers easy access to cash in community areas and reduces cash in business for retailers facing cash management and disposal problems.

- CTM enables human-to-human transactions, attracting more customers to your retail location.

Get a Demo of PKR 100,000 transaction today!

Get a Demo booked Today!

Terms and Conditions

- Cash1 is Webdnaworks Private Limited (WPL) product.

- WPL is a State Bank of Pakistan licensed company, having Commercial License as PSO/PSP for providing white label ATMs network and allied cash services.

- Cash1 is a Cash Withdrawal and other Cash-based transaction Service offered by WPL.

- All Transactions are processed in multiple of PKR 500 denominations.

- 1LINK Standard Rates Apply that are charged directly by Customer’s Bank.

- Each transaction is charged as per WPL Schedule of Charges (SoC) displayed/available at WPL Business Alliance (BA) counter.

- Cash1 Facility is available only for Debit Cards. Credit Cards and International Cards are not served.

- WPL SoC is displayed/available at BA counter. Customer should review SoC carefully before undertaking Cash1 transactions as this service cost more than average fee in the market for cash services.

- Customer has to use his own card for cash withdrawal and other Cash1 transactions at WPL BA counter. Any third party card can be refused for transaction and/or confiscated by BA staff.

- Shopping and Payment of shopping invoices after cash withdrawal is at customer’s own disposal. In case a customer uses WPL Services for payment of shopping after Cash Withdrawal at Cash1 BA counter, No Fee is charged in cash. Switch Fee is charged by Customer’s Bank directly.

- Customer must not reveal his secret PIN to anyone and key-in the PIN discretely in CTM.

- When asked, Customer has to show his photo ID and provide CNIC number / signature on the Receipt.

- Customer must collect his Debit Card and due cash after the transaction from the BA Counter.

- Customer must collect the Receipt and should review Fee, count and confirm cash as per Receipt before leaving BA counter. Complaint or claim after leaving BA CTM counter shall not be entertained.

- Customer must keep receipts carefully until verifying corresponding impact in his Bank Account. In case of any variation, WPL Cash1 Original Receipt is Primary evidence to support any complaint or disputes.

- Settlement of disputed transactions or extra value impacts will be settled as per WPL SOPs and credited in Customer card-linked Bank account, if needed. No settlement is provided in cash at Cash1 BA counter.

- Availability of Cash1 service is subject to:

- normal business hours of the Cash1 BA.

- availability of cash with BA.

- transaction system/environment.

- correct credentials of Cardholder using Cash1 CTM.

- For guidance, support or complaint, Customer can approach the BA Manager for a quick understanding and/or log the query at Cash1 Support at +9233 4413 3333 or email support@webdnaworks.com or review www.webdnaworks.com.

- 1st level Normal TAT for Cash1 complaint is one working day.

- TAT of Bank / 1LINK applies as per their Operational Guidelines.

White Label ATMs

State Bank of Pakistan’s Initiative to Enhance the ATM Network

- Banks to maintain branch & ATM ratio to 1:1

- Introduction of White Label ATM Operators concept to enhance the reach for servicing the bank consumers in form of Digital Financial Services.

PSP/PSO License from State Bank of Pakistan enables to establish New Payment Institutions for:

- ATM Switch and ATM Networks

- Automated Clearing House

- Electronic Payment Gateway for e-commerce

- POS and Pay card Schemes

- QR Based Cardless payments

- WPL to Launch White Label ATMs across Pakistan, which is a ‘Bank in a Box’ capable of both cash deposit and withdrawal.

Bank in a Box

WPL is keen to provide access to the masses, with branchless banking through its White Label ATMs which will support all transactions set required by a bank customer including but not limited to cash withdrawal, cash deposit, funds transfer, mini statements, utility bills payments etc.

This objective is the key motivator that led us to formulate a new concept for Pakistan i.e. Introducing Privately owned and maintained ATM machines, the idea was warmly supported by the State Bank of Pakistan and WPL has been provided with the Payment Services Operator/ Payment Service Provider (PSO/PSP) License to play its role for supporting SBP’s financial inclusion objective.

We intend to install (Bank in a Box) in remote locations and deprived areas of Pakistan where Cash is the basis necessity of their daily life. The Aim is to benefit the Tier 2 and 3 and even Tier 1 cities. Also to motivate low income groups towards the State Bank’s vision of enrolling financially excluded population to the financial services.

- WPL is now installing Independent WHITE LABEL ATMs across the country;

- Our WLAs are equipped to process all types of debit cards.

- To enhance the outreach, WPL intends to rollout WLA network in Tier 1, Tier 2 and Tier 3 cities.

- The services are ranging from Cash Withdrawal Facilities, Mini Statements to Balance Enquiry in Phase 1, In Phase 2 we will be offering Cash Deposit, Funds Transfer, Utility Bills Payment, Mobile top-ups and many more add-on's.

- We are aiming to deploy at least 600 ATMs in a span of 2 years throughout Pakistan

Reference Sample Sites

Beverly Centre, Blue Area, Islamabad

Faisal Movers, Jhangi Sayedan, Islamabad

PGECHS (Phase 1), Lahore

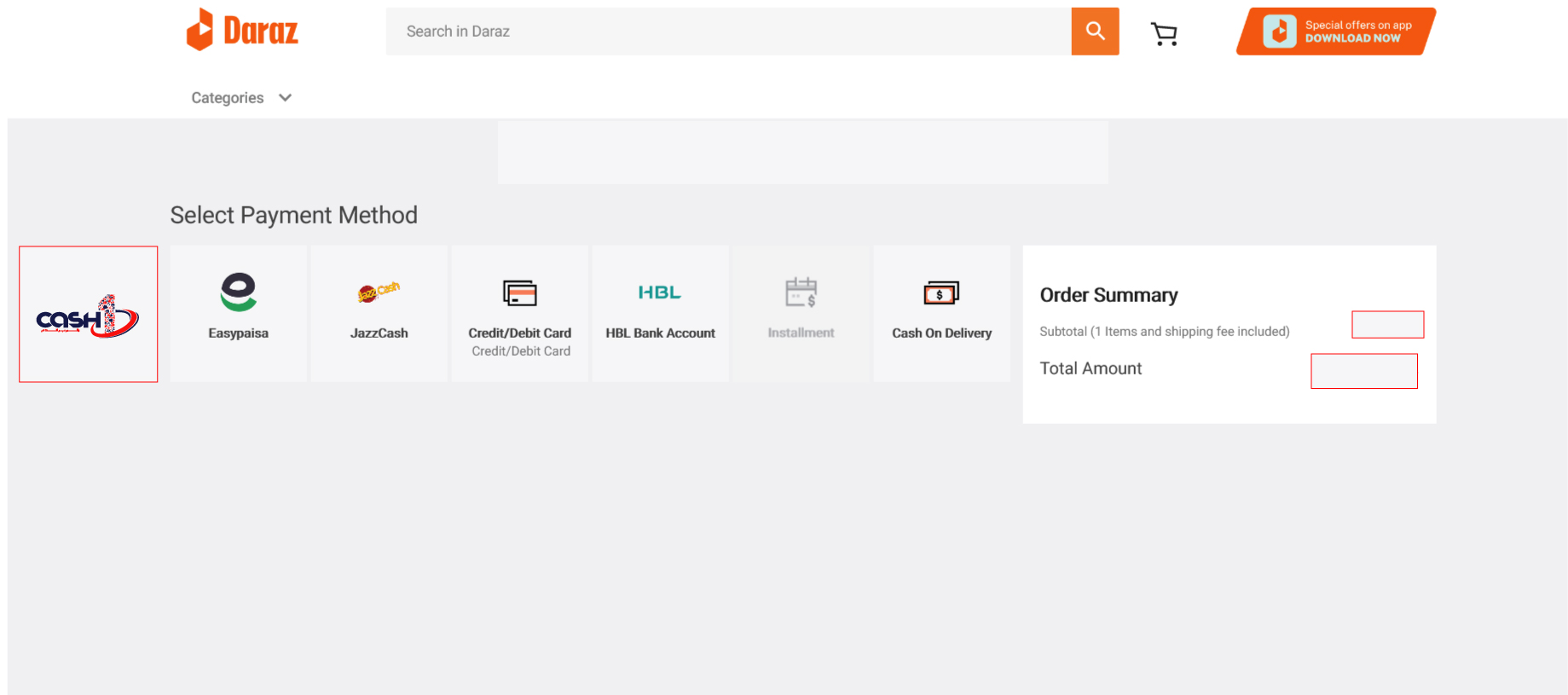

CASH1 E-Payment Gateway

1- Establishment of an independent 3rd party Payment Gateway service which provides seamless integration to Merchants for different type of payment methods:

- International Credit & Debit Cards (via International Payment Schemes – Visa/Master/CUP)

- Local Debit Cards Direct Debit Integration with Local banks with 2 Factor authentication to ensure secure transactions

- Local E-commerce Prepaid Card Issue domestic online use prepaid cards with partner banks

- QR Code based payments Secure push payments initiated by Customers from their Mobile banking apps.